CPA Exam Changes in 2024: Enhancing Assessment and Adaptability

The year 2024 brings significant changes to the Certified Public Accountant (CPA) Exam, marking a crucial evolution in its structure and content. These alterations, part of the CPA exam Evolution initiative, aim to align the examination with the dynamic demands of the accounting profession and enhance the evaluation of candidates’ skills. Below are the key modifications to make you understand better in a snapshot.

Changes in CPA Exam Structure 2024: A Comprehensive Overview

Let’s delve into the transformative changes awaiting aspiring CPAs in 2024. The CPA Exam is undergoing a structural evolution, introducing features like research-based simulations, a new spreadsheet tool, and adaptive testing enhancements. These adjustments aim to better assess candidates’ skills and adapt to the dynamic landscape of the finance and accounting industry

♦ Research and Critical Thinking Skills

- Introduction of a research task-based simulation (research TBS).

- Streamlining the exam by removing the AuthLit library to reduce restarts.

♦ Excel Spreadsheet Replacement

- Excel will be replaced with a JavaScript-based spreadsheet called SpreadJS.

- SpreadJS offers features and functionalities with limited security lockdowns.

♦ Written Communication Task Removal

- Elimination of the written communication task (essay) to align with stakeholders’ desire for technical accuracy.

♦ Adaptive Testing Changes

- Multistage adaptive testing in multiple-choice question (MCQ) testlets will be replaced with linear test design.

- This change enhances flexibility and aligns with future developments in CPA exam driver software.

♦ Sample Test Consolidation

- Consolidation of four CPA Exam sample tests into a single sample test for each section

For a more in-depth understanding of these changes, candidates are encouraged to refer to the “infrastructure-changes-to-CPA-Exam-in-2024.pdf” file.

♦ Change in CPA Exam Sections

The CPA Exam remains a comprehensive assessment, consisting of four sections, each with a 4-hour time limit. Candidates must complete all sections within an 18-month testing window. The sections and their respective areas of assessment include:

♦ Auditing and Attestation (AUD)

In the Auditing and Attestation section, candidates are evaluated on their ability to form conclusions and provide reports. This encompasses assessing risks, conducting further procedures, and understanding the intricacies of professional responsibilities in the context of auditing and attestation.

♦ Business Environment and Concepts (BEC)

The Business Environment and Concepts section delves into diverse topics critical for a well-rounded CPA. These include corporate governance, financial management, operations management, information technology, and economic concepts. A comprehensive understanding of these areas is essential for success in the BEC section.

♦ Financial Accounting and Reporting (FAR)

FAR focuses on a detailed examination of financial accounting and reporting. Candidates are tested on their knowledge of various transactions, understanding financial statement accounts, exploring the complexities of local and state governments’ financial matters, and staying abreast of standard-setting in the accounting domain.

♦ Regulation (REG)

The Regulation section encompasses a broad spectrum of concepts, ranging from business law to federal taxation for individuals and entities. Candidates are expected to navigate complex property transactions and exhibit a clear understanding of their professional responsibilities within the regulatory framework. Mastery of these diverse concepts is crucial for success in the REG section of the CPA Exam.

♦ CPA Exam Syllabus and Skill Assessment

Each section assesses various skills using multiple evaluation methods, including Multiple-Choice Questions (MCQs), Task-Based Simulations (TBSs), and Written Communication Tasks (WCTs). The skill levels assessed in each section are:

- Remembering and Understanding

- Application

- Analysis

- Evaluation

Detailed syllabi for each section outline the content and allocation of questions.

♦ Calculating CPA Exam Score

The CPA exam uses a scaled score range of 0 to 99, with a passing score of at least 75. The score is a weighted combination of scaled scores from MCQs and TBSs. Candidates failing a section receive a Candidate Performance Report for performance assessment.

♦ CPA Exam Cost

Understanding the financial aspects of the CPA Exam is crucial. The cost involves various fees, including application fees, examination fees per section, registration fees, ethics fees, licensing fees, and the expenses tied to Continuing Professional Education (CPE).

- Application Fee: $50-$200 (approx. Rs. 3,600 to Rs. 14,500).

- Examination Fee: Approx. $193.45 for each section (approx. Rs. 14,100).

- Registration Fee: Varies based on the number of sections applied for simultaneously.

- Ethics Fees: $150-$200 (approx. Rs. 10,900 to Rs. 14,500).

- Licensing Fees: Range from $50 to $500 per year, depending on the state.

- Continuing Professional Education (CPE): Required annually, costing approximately $800 to $5,000.

♦ CPA Exam Schedule and Score Release Dates 2024

The CPA Exam is administered throughout the year, with rolling score releases based on the exam date. For precise score release dates, candidates should refer to the provided schedule.

♦ CPA Exam Pilot in India

As part of a pilot program, the CPA Exam is extended to India, with Prometric test centres in multiple cities facilitating the initiative. This move is aimed at providing Indian candidates with enhanced accessibility to the CPA Exam.

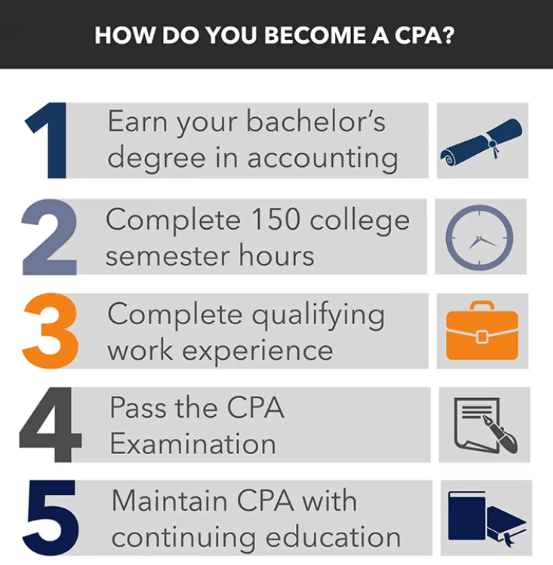

♦ CPA Exam Journey Basics

The journey to earning a CPA license involves three main components: education, examination, and experience. Depending on the jurisdiction, an ethics exam may also be required. Key steps include determining eligibility, submitting an application, and scheduling exam sections through NASBA’s CPA Central portal.

Candidates are encouraged to explore resources such as the AICPA’s CPA Exam Booklet, NASBA’s Candidate Guide, and support networks like This Way to CPA or the LinkedIn CPA Exam Candidate Group.

End Note

Becoming a CPA is a challenging yet rewarding endeavour that opens doors to exciting opportunities in finance and accounting. Candidates are advised to gather information and resources to navigate their CPA journey successfully. The 2024 changes reflect the profession’s commitment to staying abreast of industry needs and providing a robust evaluation platform for aspiring accountants.

Also, read Top 10 Finance Courses after 12th