8 Myths about Chartered Accountancy

8 Myths about Chartered Accountancy

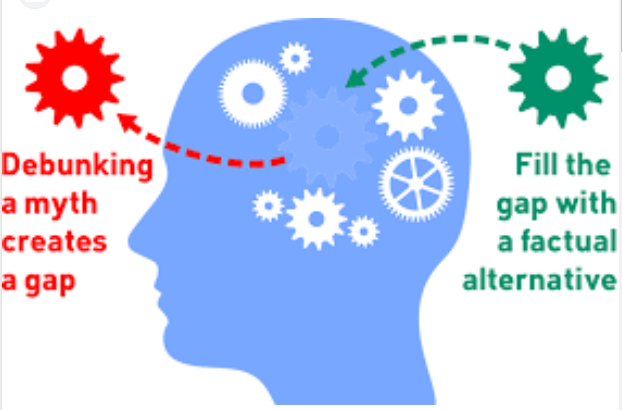

Chartered accounting is a prestigious and lucrative career that necessitates specialised skills and expertise. However, there are numerous misconceptions and falsehoods about the field that may discourage people from pursuing it as a career. We will dispel some of the most frequent CA Myths about Chartered Accountancy in this article to help you make an informed decision about whether this profession is suited for you.

There are numerous myths that need to be debunked, ranging from the notion that only commerce students may become CAs to the notion that the job is uninteresting and undemanding. You can make an informed judgement about whether chartered accountancy is the best career route for you if you grasp the realities of the industry. So, let’s have a look at the 8 Myths about Chartered Accountancy

Also read, Top Career Options after 12th Class

Myth 1: Chartered Accountancy Work Is All About Numbers

It is common to believe that chartered accountant work is all about numbers, but this is not true. Chartered accountants are financial and accounting experts who work in a variety of fields. They are prepared to handle a variety of financial tasks and responsibilities, such as financial reporting, analysis, planning, auditing, taxation, and consulting. CAs work with numbers, but they must also be well-versed in business and economics. They must be able to analyse financial data and apply it to deliver useful insights to their clients or companies. They must also have great communication skills in order to properly explain their results to both financial and non-financial parties.

Chartered accountants are strategic thinkers and problem solvers as well as number crunchers. They are critical in assisting businesses and people in making sound financial decisions. In simple terms, a chartered accountant’s job entails much more than just working with numbers. To be successful in this field, you must have a wide range of skills and knowledge.

Myth 2: Only People With A Math Background Can Become A Chartered Accountant

This myth stems from the assumption that chartered accounting is a highly mathematical field requiring significant math skills. While maths is essential, it is not the only criterion that defines success in this field. A good understanding of accounting principles and financial reporting requirements is required to become a chartered accountant.

Accounting, finance, and other similar disciplines can help you improve these skills. Excellent analytical, problem-solving, and communication skills are also required for success as a CA. As a result, a maths background is not required to become a CA. Indeed, many successful CAs have diverse educational background that includes business, economics, engineering, and even the arts and humanities. What is more vital is the ability to analyse financial data and solve difficult problems using critical thinking and smart judgement.

Contrary to popular assumption, pursuing Chartered Accountancy does not necessitate a prior undergraduate degree, as one can enrol in the programme after graduating 10+2 or equivalent with the Institute of Chartered Accountants of India (ICAI). In fact, many students who want to be Chartered Accountants start their journey straight after finishing their 12th grade.

Furthermore, there is a frequent misperception that only students from the commerce stream can become Chartered Accountants. However, this is not the case because the CA course is open to students from any academic discipline. The CA curriculum covers a wide range of disciplines, including accounting, finance, taxation, company regulations, and economics, among others.

As a result, students from any discipline who are interested in the subject should apply. However, while a background in commerce or accounting may be advantageous in the CA course, it is not mandatory. The CA course is designed to provide a comprehensive education in the subject matter, and students from non-commerce backgrounds who have a strong work ethic, dedication, and a willingness to learn can flourish in the course. Indeed, a broad collection of students from various academic backgrounds can provide fresh insights and ideas to the accounting and finance fields.

Myth 4: Being a Chartered Accountant is just concerned with income taxes

A common misperception is that being a chartered accountant is primarily concerned with income tax. While tax-related work is vital, it is not the main area of attention for a CA. CAs are financial management, accounting, and auditing experts, and their responsibilities extend beyond taxation.CAs provide financial advice to organisations and individuals, aid with financial planning and investment decisions, and help with risk management.

They must also keep correct financial records, prepare financial statements, and ensure compliance with legal and regulatory obligations.CAs also work in fields such as forensic accounting, managerial accounting, and information technology. They assist businesses in developing and implementing strategies to meet financial objectives and enhance company processes. As a consequence, it is a common misperception that being a certified accountant entails simply dealing with income tax.CAs play an important role in many sectors of finance and business, and their knowledge is recognised in a wide range of businesses.

Myth 5: You Must Have Above-average Intelligence

The notion that you must have above-average intelligence to succeed as a chartered accountant can dissuade people from choosing this career path. While strong analytical and quantitative skills are required for CAs, intelligence alone does not ensure success in this sector. Indeed, many successful chartered accountants have proved that the important attributes that lead to success are a combination of hard effort, perseverance, and a willingness to learn and adapt.

Furthermore, the CA exam assesses your ability to apply accounting concepts and principles to real-world settings rather than your intelligence. It’s vital to realise that employers don’t just look at intellect when employing CAs. They also search for people that are dependable, ethical, and have great communication abilities.

Myth 6: Accounting Professionals Must Complete Years of Education

While becoming a chartered accountant needs education and training, the process is not as time-consuming as many people imagine. The CA programme typically takes 4to5 years to finish, which is less time than many other professional courses.

Furthermore, the Institute of Chartered Accountants of India (ICAI) education and training are designed to educate students with the skills and information required to excel in the profession. Additionally, as a chartered accountant, you will have a wide choice of job options available to you. You can work for a variety of companies and organizations, or you can start your own accounting firm.

Myth 7: CA Course Is Only Accessible To Commerce Students

Many individuals believe that the CA programme is solely for business students. This, however, is not the case. The CA course is open to anyone with the necessary qualifications and aptitude. While commerce students have an edge, it is not required to become chartered accountants.

The CA course, in fact, covers a wide range of topics, including accounting, law, economics, and business management. This implies that students with a wide range of academic backgrounds can enrol in the CA programme and become successful chartered accountants.

Myth 8: Chartered Accountants Have a Boring Job

Many people feel that being a chartered accountant is a boring and monotonous career. This could not be further from the truth. Chartered accountants have varied career that involves assisting clients from many businesses in achieving their financial objectives. Chartered accountants advise organisations and people on a wide range of financial issues, including financial planning, risk management, and investment strategies.

They also audit financial statements, prepare tax reports and guarantee that clients’ financial requirements are followed. A chartered accountant must be able to analyse critically, solve problems, and communicate effectively. It is demanding and fascinating work with a rewarding career. There are numerous fallacies surrounding the chartered accountant profession that can deter people from pursuing a career in this industry. Anyone, however, can become a successful chartered accountant with the correct education, training, and experience.

CONCLUSION

Finally, the 8 Myths about Chartered Accountancy can be highly deceptive and may dissuade people from choosing this professional path. However, it is critical to understand that these beliefs are just that: myths. Chartered accounting is a dynamic profession with many obligations, and success is not restricted to individuals with a strong mathematical background or above-average intelligence.

Anyone with the proper education, training, and experience can flourish in this industry. If you want to become a chartered accountant, it’s critical to have the correct advice and support. Don’t allow these myths to prevent you from pursuing a great and gratifying career as a chartered accountant. With hard work and commitment, you can become a successful chartered accountant and make a big contribution to the financial sector.